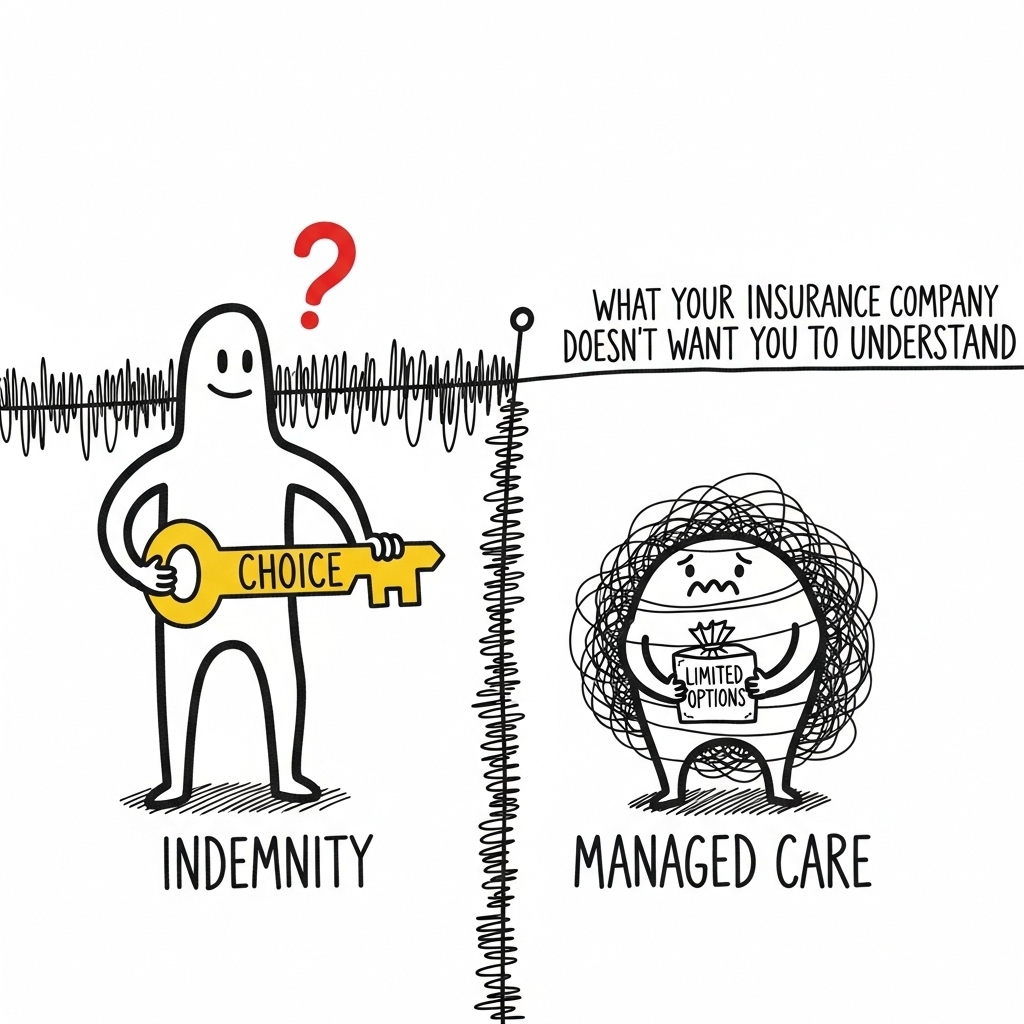

Indemnity vs. Managed Care: What Your Insurance Company Doesn’t Want You to Understand

Doug Jorgensen

February 7, 2025

Introduction: If You Don’t Know the Rules, You’ll Always Lose the Game

If you’ve ever looked at a medical bill and wondered, “Why isn’t this covered?”—you’re not alone. The truth is, most patients don’t understand what kind of insurance they have, how it works, or why it often seems like their policy is working against them instead of for them.

And that’s by design.

Today I want to explain, in plain language, the difference between two types of insurance: indemnity and managed care. Knowing the difference isn’t just useful—it’s critical if you ever need to fight for care that’s been delayed, denied, or only partially covered.

Let’s break it down.

What Is Indemnity Insurance?

Indemnity insurance is the original model for health coverage. It’s sometimes called “traditional” or “fee-for-service” insurance. Here’s how it works:

- You choose your own doctor or hospital.

- The insurance company pays a percentage of your medical costs (often 80%).

- You pay the remaining balance (commonly 20%).

This is where the term 80/20 plan comes from. Some people carry secondary insurance to help cover the 20%. Others even have tertiary plans to absorb whatever is left.

But the key is this: you are indemnified—meaning, the insurance company is there to cover a portion of your expenses. That’s it. They don’t manage your care, they don’t control your doctors, and they don’t make value judgments about whether your procedure is “worth it.”

It’s coverage, not control.

What Is Managed Care?

Managed care is what most people have today—especially if you get your insurance through an employer or Medicare Advantage.

Types of managed care include:

- HMO (Health Maintenance Organization)

- PPO (Preferred Provider Organization)

- EPO (Exclusive Provider Organization)

- POS (Point-of-Service Plan)

These plans limit who you can see, what procedures are approved, and which prescriptions you can fill. They operate networks of providers and use formularies (drug lists) and prior authorizations to control spending.

The theory behind managed care is that by keeping patients healthy and costs contained, the system works better. But here’s the part that’s not well publicized:

Managed care plans are profit engines, especially in the hands of private insurers.

And they’re good at what they do—these companies are making billions while telling you that your CT scan, surgery, or medication isn’t “medically necessary.”

How Insurance Companies Actually Think: It’s All About Medical Losses

Let’s pause and consider something uncomfortable:

When you go to the doctor and your insurance company pays the bill—that’s called a medical loss in their accounting.

Let that sink in.

If you have a heart attack, need surgery, or require a specialist, the insurer doesn’t see that as a patient being helped. They see it as a loss on their balance sheet.

Why? Because every claim they pay out takes money away from their profits. And with private insurance companies now dominating the healthcare space, that profit motive drives everything—from claim denials to narrow networks to confusing appeals processes.

Managed care organizations have gotten very good at limiting access, stalling approvals, and discouraging appeals—all while looking like they’re playing by the rules.

But Wait, Aren’t Managed Care Plans Adding Benefits?

Yes, they are. Many managed care plans offer:

- Vision care

- Dental benefits

- Gym memberships

- Free glasses or dentures

- Grocery allowances or fitness trackers

Sounds great, right?

It’s important to understand: these perks are not gifts. They’re part of a calculated trade-off. These plans limit access to specialists, expensive medications, and out-of-network care. They use pharmacy benefit managers (PBMs) to drive patients toward cheaper drug options. And the less they pay out for real care, the more they can spend on “wellness benefits” that help market the plan.

And the rest? That’s profit. Lots of it.

Why This Matters to You

Whether you’re on a commercial plan or Medicare Advantage, if your insurance company:

- Denies procedures your doctor ordered

- Rejects brand-name medications in favor of generics that don’t work for you

- Forces you to see certain doctors or use specific hospitals

- Makes you jump through hoops to access basic care

…you’re in a managed care plan. And they are legally structured to limit your care while maximizing their bottom line.

Understanding this dynamic is the first step to protecting yourself and your family.

A Word on Medicare

Traditional (or “Original”) Medicare is still a true indemnity plan. It pays a set fee for services, based on a fixed schedule. You can see any doctor that accepts Medicare, and there’s no need for prior authorizations in most cases.

However, most people on Medicare today are being routed into Medicare Advantage plans, which are managed by private insurance companies. These plans are not the same as traditional Medicare—even though they use the Medicare name.

If you’re not sure which one you have, it’s worth checking. It may explain a lot about the coverage issues you’re facing.

Closing Thoughts: Know What You’re Up Against

Your insurance card may say “coverage,” but the truth is more complicated. Whether it’s an 80/20 indemnity plan or a highly restrictive managed care policy, the system is stacked in favor of the insurer—not the patient.

That doesn’t mean you’re powerless. But it does mean you need to know what kind of plan you have, how it works, and what your rights are.

In the next article, I’ll walk you through how to fight back—including how to appeal a denial, what ERISA means for your case, and how to file a Bureau of Insurance complaint that insurance companies can’t ignore.

Until then, remember: if you don’t know how your insurance works, you’ll never win the fight when they deny your care.

About the Author

Douglas J. Jorgensen, DO, CPC, FAAO, FACOFP

Dr. Doug is a seasoned physician, federal policy advisor, and regulatory consultant who has worked extensively with providers, patients, and public agencies to unravel the truth behind health insurance practices. He is a passionate advocate for transparency, patient rights, and accountability in the American healthcare system.