How Pharmacy Benefit Managers (PBMs) Shape—and Limit—Your Prescriptions

Doug Jorgensen

February 23, 2025

Introduction: The Middlemen You Didn’t Know You Had

Most patients think the only people involved in their prescriptions are their doctor, their pharmacy, and their insurance company.

But there’s a fourth player—one you’ve probably never met—who may have more influence over your medication than anyone else.

They’re called Pharmacy Benefit Managers (PBMs), and they’re the behind-the-scenes brokers deciding:

- Which drugs are covered

- How much you pay

- What your pharmacy gets reimbursed

- And sometimes, whether you can get the drug your doctor actually prescribed

If you’ve ever been told “that’s not on your formulary,” or “you’ll need prior authorization,” a PBM was probably involved.

What Is a PBM?

PBMs are companies hired by insurance plans, employers, and government programs to manage prescription drug benefits.

They negotiate prices with drug manufacturers, create formularies (lists of covered drugs), and determine reimbursement rates for pharmacies.

The three largest PBMs—CVS Caremark, Express Scripts, and OptumRx—control about 80% of the U.S. market.

How PBMs Influence Your Prescriptions

1. Formulary Decisions

PBMs decide which drugs make it onto the list of “approved” medications for your insurance plan.

Drugs not on the formulary are often too expensive for patients to pay out of pocket.

2. Tiered Pricing

They assign drugs to different “tiers”:

- Tier 1: Cheapest (usually generics)

- Tier 2: Preferred brand names

- Tier 3+: Non-preferred, higher copays

The tier placement often has more to do with negotiated rebates than clinical superiority.

3. Prior Authorizations

Even if a drug is on the formulary, PBMs can require special approval before it’s covered—slowing down access to necessary medications.

4. Step Therapy

PBMs can require patients to “fail” cheaper drugs before approving the one originally prescribed.

This can delay effective treatment by weeks or months.

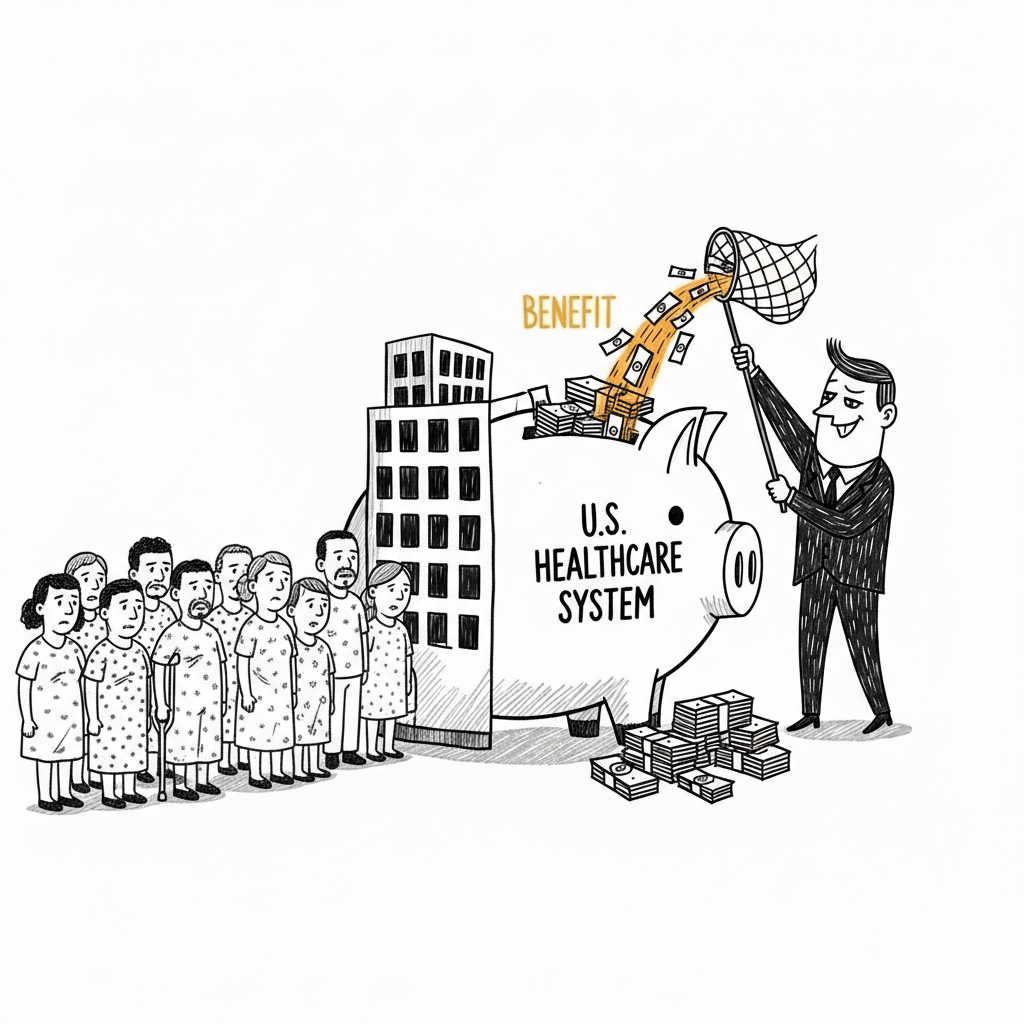

5. Rebate Games

PBMs negotiate rebates from drug manufacturers, but these discounts often don’t reach the patient.

Instead, the PBM or insurer keeps the savings.

Impact on Patients

PBMs can:

- Delay treatment through prior authorizations

- Limit options by restricting formularies

- Increase out-of-pocket costs if the preferred drug isn’t what the patient needs

- Undermine the provider-patient relationship by overruling the doctor’s clinical judgment

Impact on Providers

For prescribers, PBMs add layers of administrative work:

- More paperwork for prior authorizations

- More patient calls about denied prescriptions

- More time spent navigating drug substitutions instead of delivering care

Real-World Example

A patient with chronic pain may respond well to one specific long-acting opioid formulation.

But if the PBM’s formulary favors a different brand—due to a better rebate agreement—the patient may be forced to switch, even if the alternative is less effective or causes side effects.

How Providers Can Push Back

- Appeal Denials – PBMs count on providers giving up. Persistent, well-documented appeals can succeed.

- Document Medical Necessity – Detailed chart notes help justify why a specific drug is required.

- Know the Exceptions – Many PBMs have override codes for urgent cases.

- Educate Patients – Encourage patients to call their insurer directly to advocate for coverage.

How Patients Can Push Back

- Ask about alternatives – Sometimes a different dosage form is covered.

- Request a formulary exception – Especially if you’ve tried and failed cheaper options.

- File a complaint – With your state’s Bureau of Insurance or the Department of Labor (ERISA plans).

- Shop pharmacies – Pricing can vary based on PBM-pharmacy contracts.

Final Thoughts: The Hidden Hand in Your Healthcare

PBMs operate in the shadows of the prescription system, but their influence is massive.

They can save plans money—but they can also block access to the best treatment for the patient in front of you.

For providers, understanding how PBMs work isn’t optional anymore—it’s essential for protecting your prescribing autonomy.

For patients, knowing the role of PBMs is the first step in fighting for the medication your doctor intended you to have.

About the Author

Douglas J. Jorgensen, DO, CPC, FAAO, FACOFP

Dr. Doug is a physician, consultant, and national educator on healthcare policy and regulatory compliance. He helps providers navigate the complex intersection of patient care, insurance policy, and pharmacy benefit management.